Rolex may be the king of the secondary market, but the story gets a lot more interesting when looking at what happened to Omega in the shadow of tariffs and a shifting macro environment. While Rolex held its throne, Omega quietly went from “solid number two” to the brand quietly grinding higher in the data.

From steady second place to tariff turbulence

Omega has long been the clear runner‑up to Rolex in the high‑end Swiss secondary market, a brand with deep heritage, strong recognition, and a loyal following—but still a distant second in sheer scale. Enthusiasts often see Omega as the thinking collector’s choice: historically underrated relative to its quality, with icons like the Speedmaster and Seamaster anchoring its reputation. That backdrop matters when looking at how the brand handled the shock of U.S. tariffs on Swiss watches in 2025.

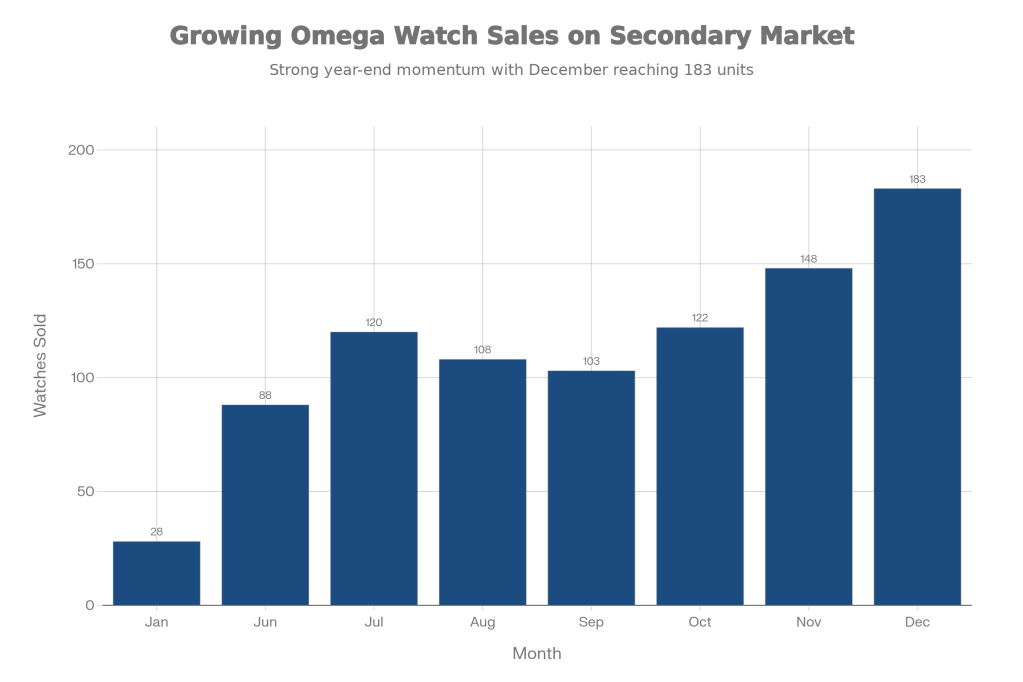

Across the year, the numbers initially suggest a stable, confident market. January saw 28 Omega watches change hands on the secondary platform I reviewed, and by June that figure had climbed to 88, setting the stage for a stronger summer. July then recorded 120 Omega watches sold, followed by a mild step down to 108 in August—nothing dramatic, just the kind of month‑to‑month fluctuation that typically reflects seasonality or auction calendars rather than a structural shift in demand.

When tariffs hit: the hesitation phase

September is where the story changes. With new U.S. tariffs on Swiss goods landing, Omega sales dipped to 103 watches. On paper, that does not look like a crash, but it does read as a collective pause as buyers suddenly had to factor in higher all‑in costs and uncertainty about future pricing. The key questions became: “Is this the new normal, or should I wait it out?” and “How much of this tariff will sellers absorb versus pass on?”

This is the classic hesitation phase markets go through when policy shocks hit. For a brand like Omega—positioned as high‑end but still more accessible than Rolex—the calculus becomes even more nuanced. Some collectors might stretch for Rolex regardless of tariffs; others, more price‑sensitive or value‑focused, might hold back on Omega until they can see where prices and liquidity settle.bcg+1

Rebound and the start of a grind higher

By October, that stutter starts to unwind. Sales recover to 122 watches, nudging above July’s level and signaling that buyers have begun to adapt to the new reality. At this stage, several things are likely happening at once:

- Retail prices are adjusting upward, making certain secondary‑market listings feel comparatively attractive.

- Sellers are calibrating expectations, accepting slightly tighter margins to keep pieces moving.

- Buyers who sat out September return with a clearer sense of what constitutes a “good deal” under tariffs.

November continues that normalization rather than delivering fireworks: 148 watches sold, a solid step up from October that shows confidence rebuilding but not yet boiling over. The important point is that, instead of fading after the tariff shock, Omega’s secondary‑market presence is quietly expanding into year‑end.

December: consolidation, not explosion

December rounds out the year at 183 Omega watches sold on the platform—its highest monthly total in this dataset, but more of a strong follow‑through than a parabolic spike. That is more than just a holiday bump; it suggests that Omega has reached a new, higher baseline of secondary‑market activity under the post‑tariff regime. Buyers appear to have accepted the new pricing environment and are still willing to allocate real money to Omega once the uncertainty premium fades.

Several forces likely converge here:

- Tariff‑driven price pressure on Rolex and other top‑tier brands nudges value‑hunters toward Omega’s mix of heritage and relative affordability.

- Year‑end buying, bonuses, and gift‑driven demand provide a natural tailwind for luxury purchases.

- Omega’s long‑running narrative—quality, design, and strong brand equity at prices still below Rolex—starts to look like an opportunity rather than a consolation prize.

What Omega’s curve says about the market

Taken together, the last few months paint a quieter but still telling picture:

- Short‑term shock: September’s 103 sales show a cautious market reacting to new tariffs.

- Gradual normalization: October’s 122 and November’s 148 highlight how quickly collectors adapt when they still want what a brand offers.

- Higher plateau: December’s 183 suggests Omega has emerged from the turbulence with more consistent secondary‑market demand than it had at the start of the year.

In the earlier look at Rolex, the data showed a giant absorbing tariff turbulence and still powering ahead as the dominant force in volume and value. Omega’s trajectory tells the complementary story: when the crown becomes more expensive and policy uncertainty creeps in, the market does not stop—it rotates. And in that rotation, Omega becomes the rational beneficiary, steadily building liquidity and relevance in the secondary market.

For anyone watching this space seriously—collectors, flippers, or investors—the message is clear. Tariffs did not just reshape prices; they reshaped behavior. Rolex remains the benchmark, but the past year suggests that Omega, the “distant second,” is where a growing share of real‑world buying activity is quietly gathering momentum.

- https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/attachments/images/19297163/68f4daca-188d-4537-b5e4-f1c1d285f9de/image.jpg

- https://about.chrono24.com/en/press/luxury-watch-analysis-rolexs-dominance-on-the-secondary-market

- https://www.hodinkee.com/articles/used-watch-market-prices-enjoy-best-performance-in-more-than-three-years-as-cartier-omega-rolex-and

- https://www.hodinkee.com/articles/rolex-gains-pace-secondary-watch-market-price-declines-to-slowest-since-2022

- https://blog.watchanalytics.io/p/watch-industry-report-2025-part-2

- https://www.bcg.com/publications/2023/luxury-watch-market-trends

- https://www.investmentwatches.com/blogs/blog/luxury-watch-investment-myths-debunked

- https://www.diamondbanc.com/insider-news/top-luxury-watches-in-2025-in-the-usa/

- https://finexity.com/en/blog/the-run-on-luxury-watches-why-rolex-more-are-a-hit-with-investors

Leave a comment